Detailing SC&RF’s new workforce study

09 August 2023

Workforce challenges are a mainstay of the specialized transport and lifting industry, which often struggles to recruit, train and retain workers. As well, pertinent research and information regarding workforce issues is difficult to find.

But this is no longer the case. After two years of comprehensive research and analysis, the Specialized Carriers & Rigging Foundation (SC&RF) has published a new study: “State of the Workforce in the Crane, Rigging and Specialized Transport Industry.” The study was designed to examine and identify a range of workforce issues within the construction and specialized transportation sectors, according to Geoff Davis, CEO at Unified Logistics, who was the architect of the survey and SC&RF president at the time of its development.

Davis said the motivation for the study was to publish a definitive publication that covered such data as employee dynamics, wages and recruitment/retention.

“[Our goal was to] make it a living document that will be renewed annually to account for changes in that data,” said Davis.

Industry specific

Surveying began in 2021 in three sectors: Oversize/Overweight Transportation Services, Crane Rental & Services, Rigging Services and Support Services. The survey asked companies specific questions about their workforce and the challenges they encounter.

Ultimately, 64 companies completed the survey in full, which resulted in 83 sector-based responses – comprising a productive range of assessment areas, including: In-Field/Operations Occupations, Maintenance, Apprentice/Trainees, Operations Management and Corporate Positions. Within these categories, the survey focused on education level, wage range, length of employment and turnover.

Davis and the SC&RF team was diligent in determining the types of questions that were asked in the survey.

“We didn’t want to put a particular burden on those willing to engage with us, and we wanted to make sure that we asked questions by specific industry segment,” he said. “We knew we’d need to customize questions, and as a result, the ability to see the data is similar across all of the different verticals, but it’s still data specific to that vertical.”

He also wanted to make sure that SC&RF’s sample size and methodology was statistically sound, and that the information being delivered was clear and unbiased.

“It can be easy to go in with an agenda, but our agenda on this was pure – to find out what the industry does, what it likes and doesn’t like to do, what it does or doesn’t do well and not make judgments on it but say here’s the data, here’s what our members have told us,” he said. “So, this publication is, without a doubt, data driven.”

Another goal was to bridge the skilled labor gap, according to current SC&RF President Jennifer Gabel, who is also president and owner at JK Crane.

“This study uses data to pinpoint where the opportunities are and provides companies with key focus areas to help them recruit better, thereby strengthening their companies and the industry as a whole,” she said.

Looking ahead, Gabel hopes the study motivates the industry to continue to work together and tackle the worker shortage more collectively.

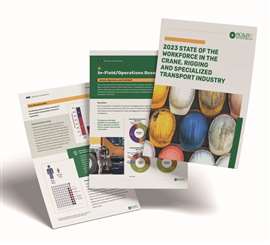

“The State of the Workforce study shows what many of us probably already know, that our industry is severely lacking in diversity,” she said. “While diversity goals do not supersede merit, it’s my hope that we as company leaders use this knowledge to ask how to attract qualified candidates from a more diverse pool. Moreover, this study indicates that it’s going to take a collaborative effort amongst companies, unions and training schools in order to succeed.”

Confidential data

One thing that the SC&RF team wanted to assure was that no proprietary data was exposed and that all data gathered was kept strictly confidential.

“We protected everyone’s confidentiality – so this data doesn’t give anyone a competitive advantage,” he said. “Second, we were able to gather large amounts of data painlessly. And third, inside of the research, our ability to construct the questions, so that we’re answering the right questions, is becoming a core competency.”

Updates will be conducted annually. Davis said they plan to drill down on regionality in the 2024 survey.

“What does location, regulation, even technology have to do with some of these details?” he asked. “So, we’re looking to provide even more context and utilize the ability to track market changes, technology and workforce changes over time – in order to create relevant time series data.”

Quick reveals

Eighty-two percent of the workforce is male. This proportion increased slightly when it was weighted by the size of a firm’s workforce. For reference, about 53 percent of the U.S. labor force is male.

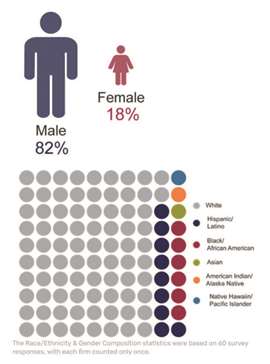

Wages for Crane Operators were the highest on average with 87 percent of firms responding that they pay operators over $35 per hour. The same statistic for Rigging Services, Transportation and Supporting Services was 47 percent, 27.5 percent and 33 percent, respectively. When interpreting the average wages for Drivers, Operators and Field Staff, it is useful to reference the average hourly wages that correspond with the associated education levels or alternative skilled trades.

Reference points were compiled and provide the average 2021 wage as compiled by the Bureau of Labor Statistics (BLS):

- All occupations: Less than a high school degree $15.65 per hour and high school degree $20.23 per hour

- Skilled trades: Construction equipment operators, $26.87 per hour; electricians $30.44 per hour; welders $23.21 per hour and heavy and tractor-trailer truck drivers $24.20 per hour.

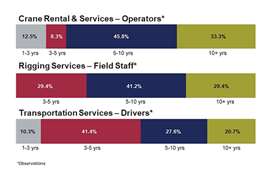

About one-third of Crane and Rigging firms responded that their average length of employment was 10-plus years.

Overall, Crane and Rigging had a longer average length of employment than Transportation, whose most frequent category was 3 to 5 years of employment. For reference, according to the BLS, the median length of employment with an employee’s current employer for the manufacturing sector was 5.2 years, the construction sector was 3.9 years, and the overall private sector was 3.7 years as of a January 2022 survey. Similarly, transportation and material moving occupations had an average tenure of 3.1 years.

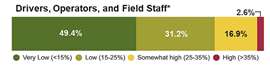

The turnover rate across all sectors is fairly low with nearly 50 percent of respondents having under a 15 percent turnover rate and an additional 31.2 percent of respondents with under a 25 percent turnover rate. Similar to the sector’s longer-than-average length of employment, BLS reports much higher turnover in related industries.

For example, BLS reported the 2021 annual turnover rate for the construction industry was 56.9 percent, manufacturing was 39.9 percent, and trade, transportation and utilities was 54.5 percent.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.